door: RYBN

“The Algorithmic Trading Freakshow is a collection of uncommon, unnatural, shocking and scandalous specimens of speculative trading algorithms. Forgotten by the markets, obsolete, inoperative, these pieces of collection are organized for the occasion under the form of a cabinet of curiosities.

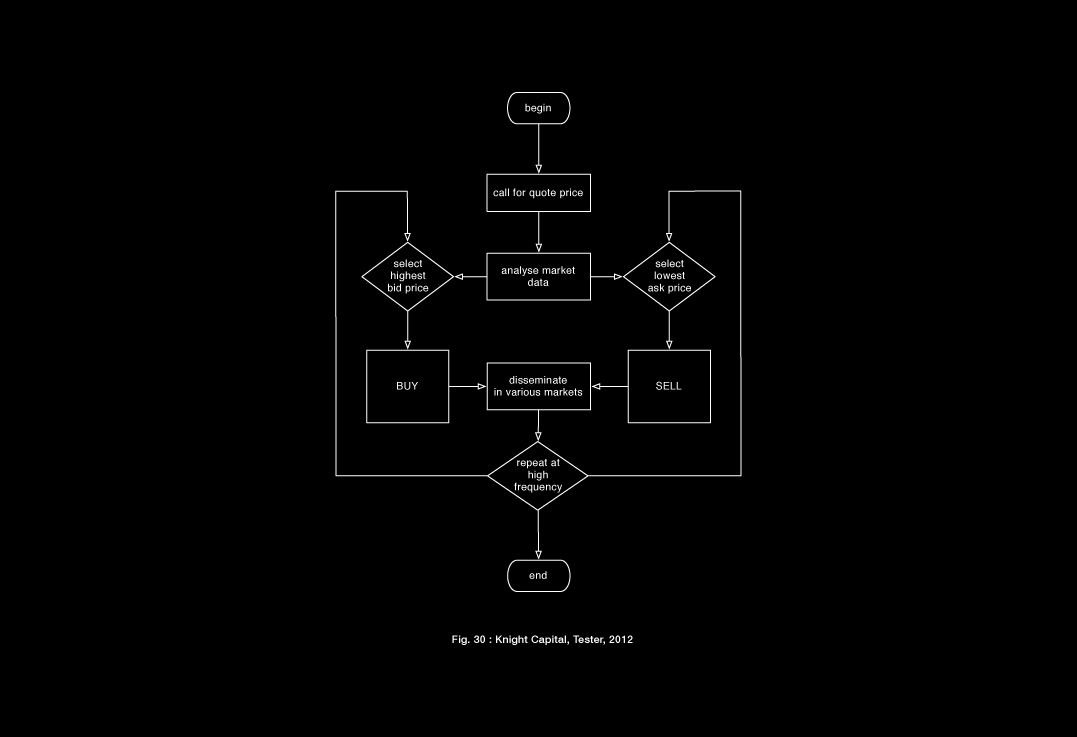

All along the history of finance, numerous experiments have been conducted to foresee through the markets mysteries. Since the conceptual introduction of financial mathematics with Bachelier in 1900, speculators of all kind have been trying to understand and predict the market moves with the help of probabilities, chaos theories, fractals, quantum physics, computer science and, nowadays, at the era of High Frequency Trading, algorithmic engineering. However, beside of these scientific researches, numerous non academic experiments have been realized and documented, exploring the esoteric correlation of prices variations with meteorology, astrology, numerology, sports and/or zoology …

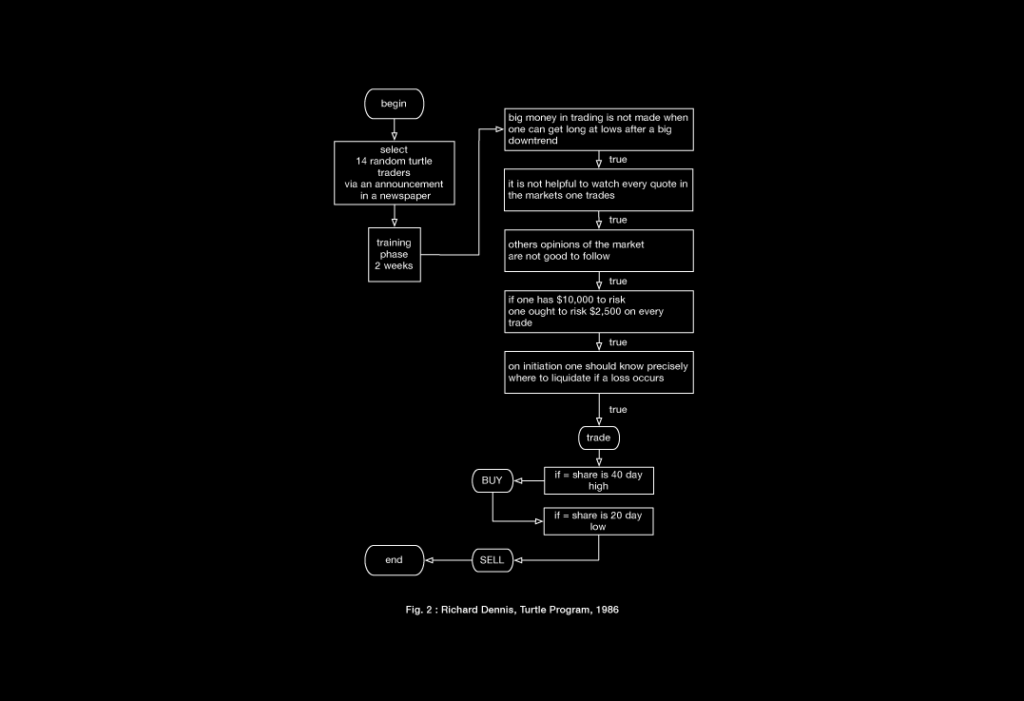

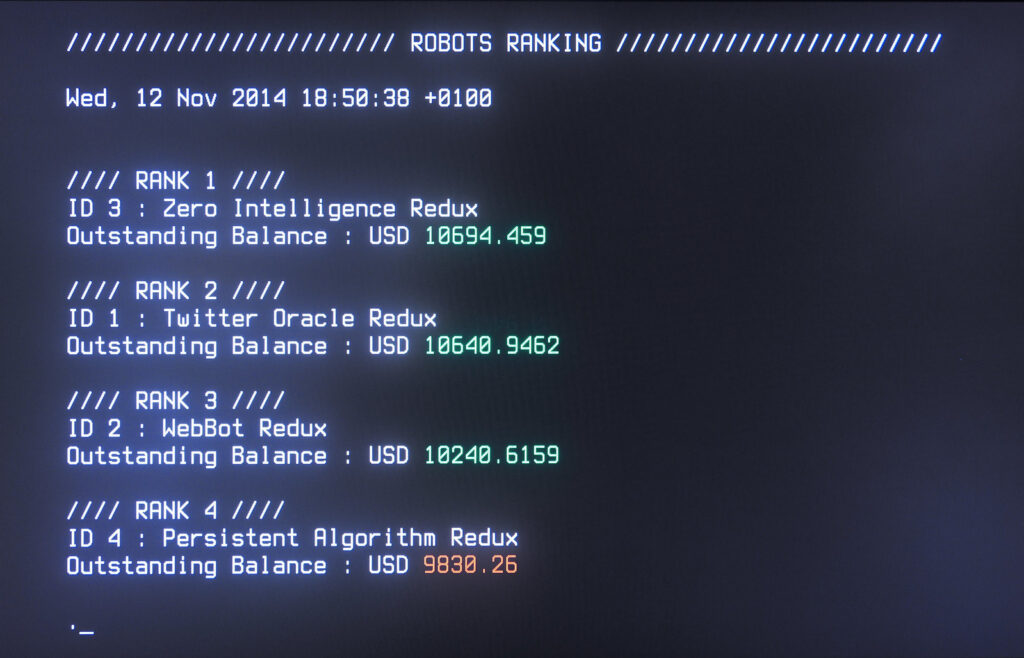

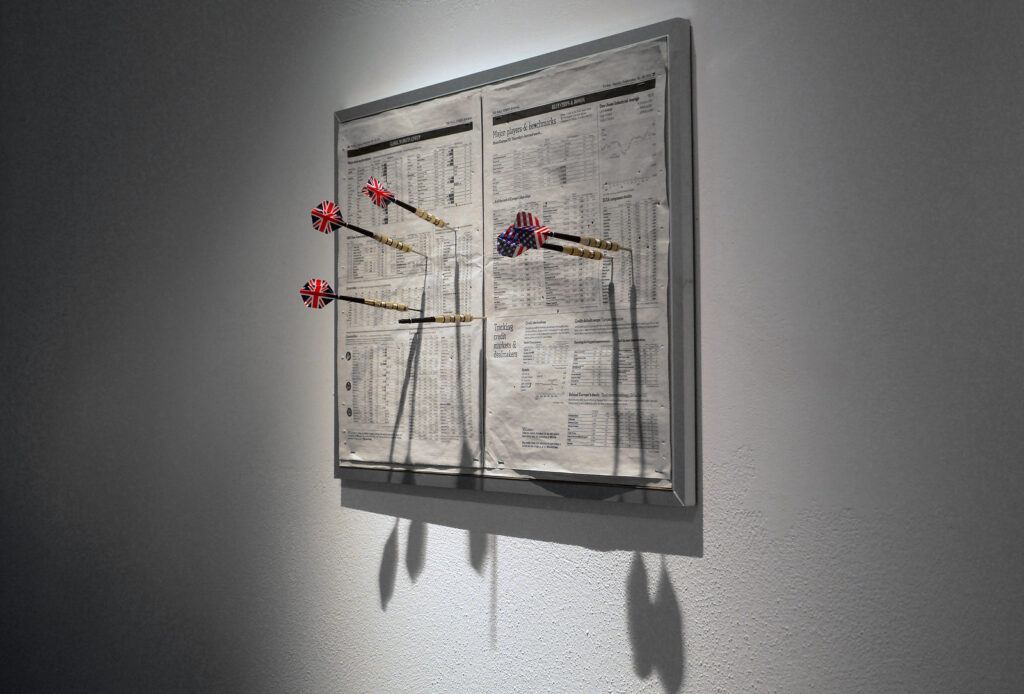

To mention a few notable of these experiences : Malkiel’s blinded chimpanzee (1973) and its russian repetition with Lusha (2010); Richard Dennis turtle experiment (1980); Gode & Sunder Zero Intelligence investment model (1993); the Raven Thorogood III MonkeyDex (1999); investing with darts (WSJ dartboard 1999 /2001); with a 4 years old child (Tia Laverne Roberts – 2001); catching the obscure relationships between Soccer and Markets (Leeds University, 2003/2006); the DCM twitter-based prediction hedge fund (2010); Despite all these attempts, the intricacies of finance remain impenetrable. We still seek to interpretate the meaning hidden in the fluctuations of the markets, as it has been cruelly demonstrated with the recent crisis, the debt collapse and the notation agency debacle.”

http://rybn.free.fr/ANTI/AFS.html

http://rybn.free.fr/ANTI/agents.html